Private Fund

What is a private fund ?

Investor properties

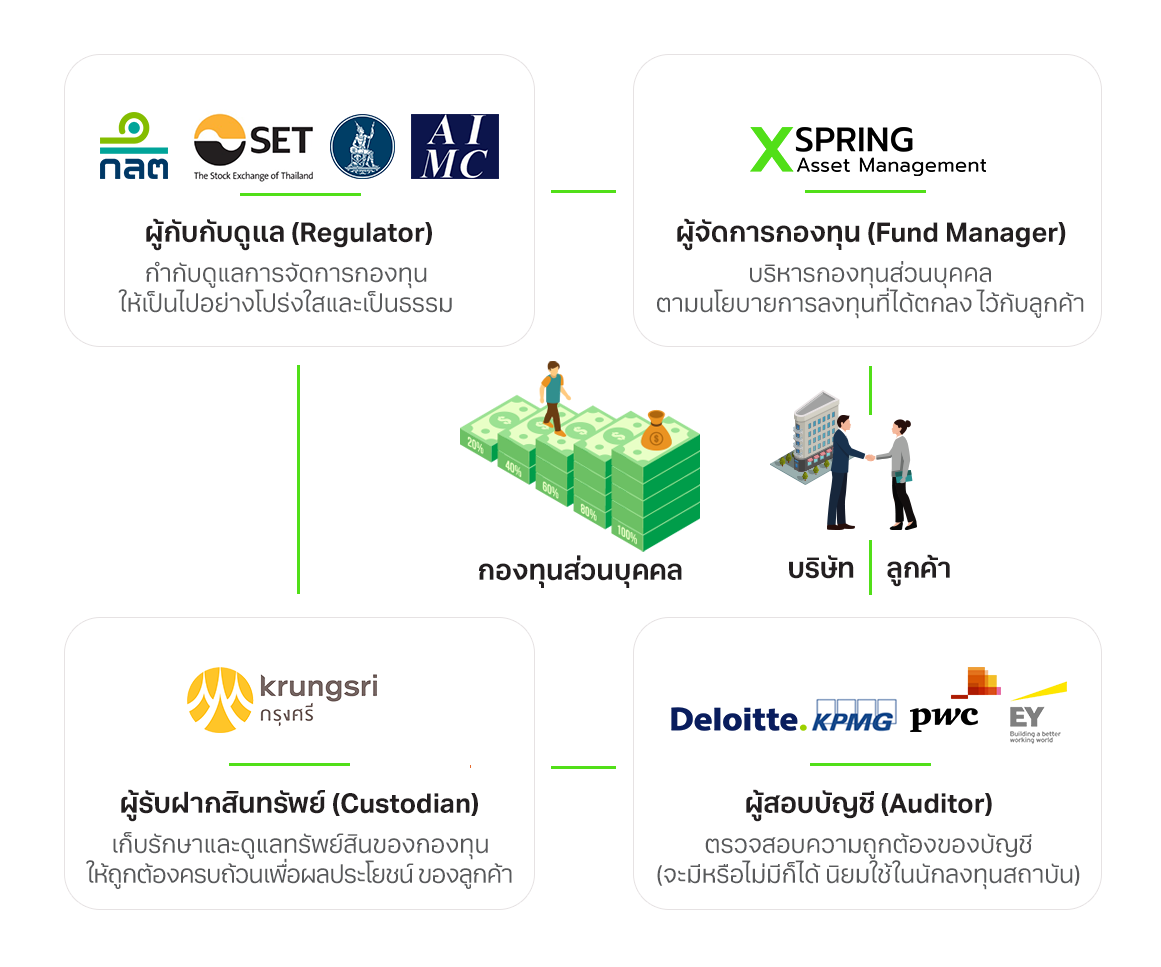

Private funds are protected by laws and organizations

The structure of private funds

Private fund investment policy

| Investment policy | Proportion of investment in debt instruments and other debt-like instruments | The proportion of investment in equity instruments and other instruments that are similar to equity | Expected return |

|---|---|---|---|

| Expect the least return (Conservative) | 80-100% | 0-20% | Higher than interest on deposits |

| Expect moderate returns (Moderate) | 40-60% | 40-60% | Expect moderate returns, moderate risks Conservative |

| Expect high returns, high risks (Aggressive) | 0-20% | 80-100% | Higher than the investment policy Aggressive |

Expect Less Returns

Conservative

Expect Moderate Returns

Moderate

Expect High Returns

Aggressive

Debt instruments and debt instruments

Debt instruments and debt instruments

Equity instruments and equity-like instruments

Equity instruments and equity-like instruments

Tax burden of private funds

Private Fund How is it different from mutual funds?

The return on investment in private funds may also be subject to tax as the owners status. (That may be either a natural person or a juristic person), for example, if you are an individual and a private fund, invest money in debt instruments that receive interest as interest The interest received must be taxed normally. (But if it is a mutual fund, when investing money and receiving returns in the form of dividends or interest Will be exempt from taxation)

Investors in private funds should have a good understanding of investment. In order to have an understanding of the investment policies presented by the fund manager And can jointly set up investment policies that are suitable for themselves

Benefits of investing in private funds

- Increase investment opportunities directly than investing in securities directly And investments can spread risks more than direct investment By using a professional fund manager team to select and allocate investment funds for investors

- Privacy And is more flexible than investing in general mutual funds The investor is the policy maker in conjunction with the fund manager. And can change the investment policy according to their needs And can cancel the contract at any time (Must notify written termination request only)

- Can access investment details closely As if investing by yourself

- Management companies will always find opportunities to invest in new instruments that provide high returns, such as instruments offered in the first market, etc.

- Have more bargaining power from the management of mutual funds

- Reduce the burden of contacting financial institutions Monitoring news and self-management

Contact

Call. 02-030-3730

+4.18%

+4.18%

-0.01%

-0.01%